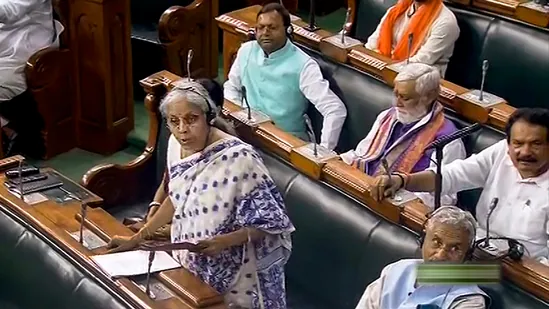

Parliament, on Friday, passed amendments to the Central and Integrated GST laws, which will impose a 28 per cent tax on the entire bet amount in online gaming, casinos, and horse race clubs. The Rajya Sabha returned the proposed legislations to the Lok Sabha without any discussion through a voice vote. Earlier in the day, the Lok Sabha approved both money bills – The Central Goods and Services Tax (Amendment) Bill, 2023, and The Integrated Goods and Services Tax (Amendment) Bill, 2023. Union Finance Minister Nirmala Sitharaman introduced these bills in both houses of Parliament. This development took place on the last day of the Monsoon session.

The amendments focus on including a provision in the Schedule III of the CGST Act, 2017, to provide clarity on the taxation of supplies in casinos, horse racing, and online gaming. In addition, the amendment in the IGST Act aims to impose GST liability on online money gaming offered by offshore entities, requiring them to register for GST in India.

Moreover, the amendments will enable the blocking of access to online gaming platforms situated abroad if they fail to comply with registration and tax payment requirements. The GST Council had previously approved the amendments to the Central GST (CGST) and Integrated GST (IGST) laws. They had agreed to levy a 28 per cent GST on the total face value of entry level bets in online gaming, casinos, and horse racing.